-

AuthorRajat Khaneja

-

Comments0 Comments

-

Category

2,689 total views

Often, we have heard that holding a position of a director in a company is a big thing. People aspire to become a director as it is the top most designation in a company. You may be having a very fancy image of this position in your mind. However, you should not forget with great power comes great responsibilities. There is other side of the coin too.

Indian corporate laws are now very strict and have many penal provisions for any mismanagement or non-compliance by the person holding the position of a director in a company.

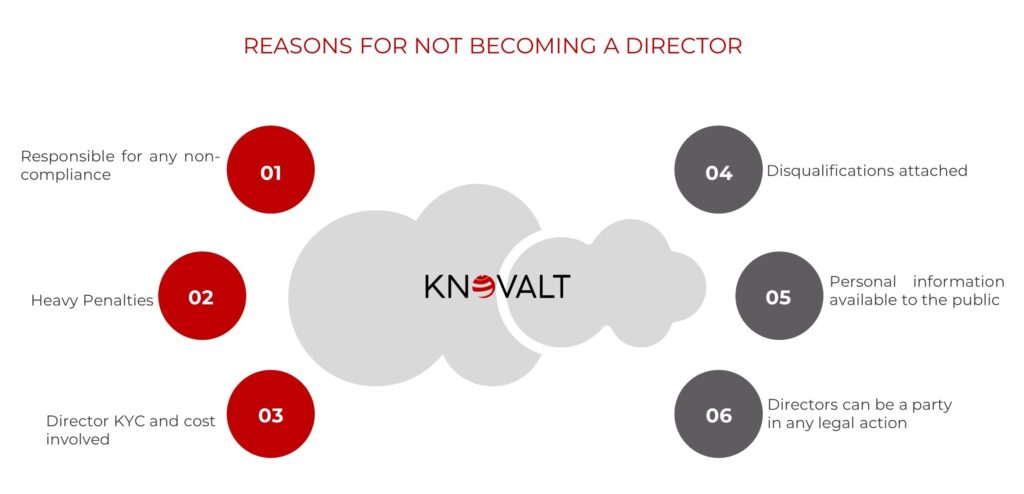

There are many reasons for not choosing to become a director of a company. Here are some of the points you should have in mind before becoming a director in a company.

Responsible for any non-compliance

Directors hold the fiduciary position in a company. They are responsible for proper management of business and compliance with the legal provisions applicable on the company. Any kind non-compliance may result in company paying hefty penalties and, in some cases, facing legal actions too. Job of a director is not easy. Even a simple error in performing the duties may have adverse consequences.

Heavy Penalties

The Companies Act, 2013 contains heavy penalties for any contravention of law. In some cases, there is no upper cap on the penalty amounts. In addition to monetary penalties, there are provisions related to confinement too.

Some people would argue that these penalties would be borne by the company and not by the director. If we look closely to many legal provisions in the Companies Act, 2013, directors and officers in default are personally liable to pay the penalties. Furthermore, there are many other laws which hold director responsible for non-compliances.

Director KYC and cost involved

A unique number is allocated, namely Director Identification Number (DIN), when someone becomes a director for the first time. Even if a person resigns subsequently, DIN remains allotted to the person and activated.

Every year a DIN holder has to submit his KYC documents / information to keep the DIN activated. It’s an additional cost to be paid on yearly basis to a professional by him.

Moreover, if he fails to complete the KYC, the DIN will be deactivated. He will not be able to use it and become a director in a company unless the DIN is reactivated by completing the KYC and paying the government fee of Rs. 5000/- (Rupees Five Thousand Only).

Disqualifications attached

There are many legal compliances applicable on a company. These compliances are required to be completed on regular basis. Non-compliance with these provisions may disqualify a person to be a director in any company. For instance, provisions related to filing of annual return and financial statements with the Registrar of Companies (ROC) under section 92 and 137 of the Companies Act, 2013, respectively. If a company fails to submit annual returns or financial statements with the ROC for three continuous years, all the directors associated with the company shall be disqualified to be a director in any company. Such disqualification shall continue for five years.

Personal information available to the public

In order to become a director of a company, electronic forms are filed on the website of Ministry of Corporate Affairs (MCA) (www.mca.gov.in). Identity and address proofs are attached with these forms. Moreover, contact details are also mentioned in the forms. These forms are available for download by others by paying a fee of Rs. 100/- (Rupees one hundred only). Therefore, anyone can access your personal information by paying this amount.

Directors can be a party in any legal action

Directors are the main persons who are running the business of a company. Any person dealing with the company may take legal action against the company and make directors a party to the suit. Directors may be held personally liable in any legal case. This position is always vulnerable to these kinds of legal issues.

In conclusion, it is advised that one should think it through and weighs the pros and cons before becoming a director of a company.

If you are facing any issue in resigning as a director of a company and company is not letting you leave the position, we can help you. Feel free to contact us. CLICK HERE to contact us. You may also send a text on WhatsApp by CLICKING HERE

Leave A Comment Cancel reply

Recent Comments

- Why registration of a Private Limited Company is not a good idea? : Knovalt on One Person Company (OPC)

- Why registration of a Private Limited Company is not a good idea? : Knovalt on Registration of a Private Limited Company In India

- Rajat Khaneja on Essentials of a valid letterhead

- Udyog Aadhaar Registration Fees on Micro, Small & Medium Enterprise (“MSME”) Registration

- Sonal on Casual Vacancy in the office of Auditor(s) (Non-Govt company)