-

AuthorRajat Khaneja

-

Comments0 Comments

-

Category

2,906 total views

Starting up a business in a registered form gives an advantage to the business in terms of proving its establishment and credentials to various stake holders. However, not all forms of registered entities shall give an advantage to the business. Weighing pros and cons of the form of entity before registering it is very crucial.

One of the most famous forms of entity is a private limited company. Especially, after boom in the start-up ecosystem in the country, entrepreneurs are choosing this form to start their businesses. A private limited company is the most preferred and popular form of entity in case of start-ups because of ease and flexibility it gives to investors and promoters. There are various kinds of securities and modalities in which funds can be raised in a private limited company. It also gives investors the advantages of limited liability and keeping a check on the operations of the company by appointing a nominee director on the board the private limited company. However, this form is not suitable for all new businesses. One should not forget to check the negative side of this form of entity as well.

To start with, we should first discuss about the meaning of and requirement for registering a private limited company. Private limited company is defined under the Companies Act, 2013. There is a requirement of at least two persons, who can be directors as well as members of the company. Members are the owners of a private limited company and contribute funds. Directors play a vital role in a company’s operations and responsible for proper management of business of the company. Members can be directors as well. Maximum member in a private limited company is restricted to 200.

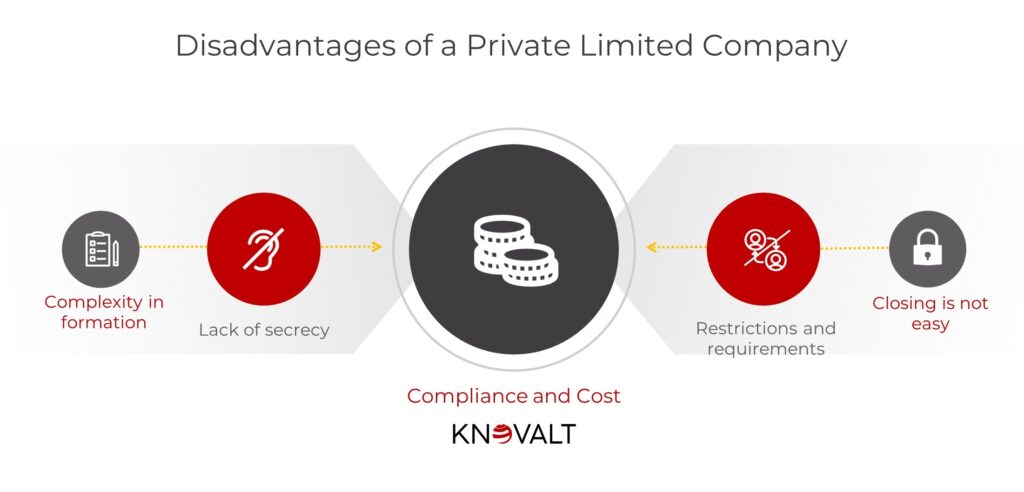

There are many advantages of doing business as a private limited company. However, there are many disadvantages of a private limited company too. It is not suitable for all kinds of businesses. There are many factors which should be considered before incorporating a private limited company. Following are some of the negatives of a private limited company which you should consider while making a decision to register a private limited company in India.

Complexity in formation

Registration process of a private limited company is a very complex and involves many steps. Engagement of a professional is inevitable. Many legal formalities have to be completed, many documents have to be prepared and submitted and various permissions have to be obtained to register a company.

Further, it’s a time taking activity which involves some tasks to be done by the owners as well such as collecting and collating required documents, signing and follow up etc. CLICK HERE to understand the process of registration of a private limited company.

In addition to complexities, cost is also involved such as cost of name reservation, cost of procuring digital signature certificates, registrar fee for incorporation and fee for professional services.

Registering a private limited company involves a process and costs which are not applicable for an unregistered entity like proprietorship. Thus, if you want to start a conventional business with no outside investment expected, you may choose proprietorship or a partnership firm over a private limited company. It will save your time, efforts and money.

Lack of Secrecy

Many disclosures are required to be made while filing for registration of a private limited company and subsequent filings. As per Companies Act, 2013, a company is required to provide a lot of information such KYC of directors, financials of the company, details about operations and other things. All this information is available on the web portal of Ministry of Corporate Affairs (MCA) (www.mca.gov.in).

Data of a private limited company can be accessed by anyone by paying a very nominal fee i.e. Rs. 100 (Rupees hundred only) on the official website MCA.

Therefore, you cannot keep the financial data and information of the persons related to the company secret. It is very difficult to maintain complete secrecy about the operations of company.

This data is utilised by people such as credit card companies, banks, direct selling agents, mutual funds sellers, insurance agents and many others for selling their products to the directors and the companies.

Compliance and Cost

Private limited company are formed under the Companies Act, 2013. There are many compliances which are required to be done by a private limited company under this act such as holding meetings, maintaining minutes, audit of accounts, annual returns and informing registrar for any change in directors etc. These compliances have cost attached to them like government filing fee and fee of professionals as well. In case of any delay in adhering to the timelines envisaged under the act for making these compliances, penalties are applicable which may increase on daily basis. Even if your revenue was zero during the financial year and your company was not operating, you will have to make these compliances. These compliances are not applicable on proprietorships and partnerships.

Many consultants and service providers would not tell you about these compliances and encourage you to register a private limited company at a low cost initially. It’s a trap for you. Once you register a private limited company, these compliances are unavoidable and therefore, you may approach these consultants to do the compliances. That’s how they will get regular work and fee from you.

It is advisable to register a private limited company only when you have good professionals or a team to handle these compliances and a business which generates sufficient revenue which can absorb these costs. Else, you may end up in paying hefty penalties unnecessarily and incur more expenses than income.

Restrictions and requirements

There are many restrictions imposed by the Companies Act, 2013 over a private limited company such as restrictions on transfer of shares (ownership in simple words), number of maximum members, access to funds and giving funds to others. To explain a few of these restrictions, a private limited company cannot take loan from an individual who is not a director or his relative. Therefore, you may not be able to take funds from others to expand business and if you do so, you will have to pay heavy penalties. You cannot transfer shares unless authorised by the articles of the company. You may amend the articles by following a procedure which involves cost.

Apart from the aforementioned restrictions, there are various other requirements to register and keep operating a private limited company. In order to keep a private company complied and active, there should be:

- a minimum number of two Directors in the company at all the time

- one director who has to be an Indian Citizen and Indian Resident

- at least two Shareholders of a company

A single person cannot start a private limited unless he forms a one-person company (OPC) which has its own disadvantages.

Closing is not easy

Closing a private limited company is also a very complex task. It involves cost, time and efforts. There are two ways to close a company i.e. winding up method and strike off method. Winding up method is a lengthy method with huge cost involved whereas strike off methods can be used if a company meets the eligibility criteria. Therefore, closing down a private limited company is equally complicated.

You may consider the above points before registering a private limited company. It will help in saving your time, efforts and resources. For more information on company incorporation, CLICK HERE to contact us. You may also send a text on WhatsApp by CLICKING HERE

Leave A Comment Cancel reply

Recent Comments

- Why registration of a Private Limited Company is not a good idea? : Knovalt on One Person Company (OPC)

- Why registration of a Private Limited Company is not a good idea? : Knovalt on Registration of a Private Limited Company In India

- Rajat Khaneja on Essentials of a valid letterhead

- Udyog Aadhaar Registration Fees on Micro, Small & Medium Enterprise (“MSME”) Registration

- Sonal on Casual Vacancy in the office of Auditor(s) (Non-Govt company)